It’s no secret that in today’s digital age, defined by exponential growth in artificial intelligence, cloud computing, and other data-driven services, the major constraint on data centres is not computing capacity or network bandwidth, but the availability and cost of electricity. Global data centre power consumption is rising to unprecedented levels: the International Energy Agency anticipates that such consumption may double to around 945 TWh by 2030, surpassing the current electricity use of many nations. Energy strategy has emerged as a crucial driver of asset value, operational resilience, and investment performance.

How Energy Strategy Redefines Asset Value

For data centre investors and operators, energy now defines the economics of digital infrastructure assets. The electricity consumption of a single hyperscale facility’s servers and cooling systems may amount to over 100MW, which is equivalent to hundreds of thousands of homes, placing immense pressure on ageing and constrained power grids.

Projections estimate that UK data centre power consumption may double within a decade to comprise 14% of total national electricity demand. In the US, some industry forecasts anticipate that electricity demand will grow at between 2% and 3% annually, with data centres responsible for a significant proportion of new demand.

Access to Power as a Scarce Resource

Grid constraints are evolving into fundamental barriers for value creation in the data centre sector. Lengthy delays in securing grid connections have grown ten-fold in the UK over the last 5 years, now reaching up to 15 years. Industry groups across the EU are observing seven to ten-year connection queues in legacy hubs, with some projects facing queues of up to 13 years. The IEA now estimates that approximately 20% of planned data centre capacity additions through to 2030 are at risk of delay due to grid connection constraints.

These multi-year delays pose material threats to project timelines and operational cost structures, deferring revenue streams and amplifying financing costs, ultimately eroding risk-adjusted returns and causing institutional investors to reconsider exposure. As a result, governments across the world are initiating grid connection reforms designed explicitly to attract and retain investment, while deterring speculative projects.

Grid Reforms

In Great Britain, for example, delays have prompted regulatory reforms aimed at removing so-called “zombie” projects that occupy connection queue positions without demonstrable development progress. Simultaneously, the regulators propose to implement a “first ready, first needed, first connected” prioritisation framework which will reward project readiness and strategic importance, including data centres and renewable electricity generation projects, by the end of 2025.

In locational pricing markets, including parts of the US, wholesale prices in grid-constrained zones already reflect transmission congestion and local supply-demand imbalances. Consequently, data centres in grid-constrained areas can be subject to elevated spot prices and capacity premiums, which may prompt investment in nearby alternative generation or storage.

Forthcoming reforms to electricity market design in several jurisdictions, including Great Britain, Australia, and Canada, may likewise support valuation premiums for co-locating generation and load, reinforcing the principle that capacity should follow demand.

Reforms like this will afford competitive advantages to investors with sophisticated development capabilities and established regulatory relationships who may be well placed to navigate the transition to the new rules. Regardless, land with existing grid access is becoming a premium resource, meaning established data centres or development sites with secured grid connections may yield enhanced asset values, while new facilities may face intensified competition for connection capacity.

Other Grid and Resilience Considerations

Grid connections are often sized to provide additional capacity during peak demand periods, ensuring operational continuity during periods of usage, while also maintaining resilience during force majeure events or other unforeseen disruptions to onsite or private wire generation. Power outages can disrupt connectivity, and trigger potential liabilities, including compensation for affected customers, fines from regulators, and reputational damage.

Given that electricity costs tend to comprise a significant proportion of data centre operational expenditure, investors will also want to also evaluate the regulatory frameworks governing availability and redress in the event of network disruption in each relevant jurisdiction, as well as consider the ability of operators to pass though costs associated with any outages onto tenants or customers.

For new or redeveloped assets, investors may also wish to evaluate the resilience of grid connection arrangements under future expansion scenarios, regulatory changes, and technology upgrades.

This may require rigorous analysis of existing connection agreements, capacity allocation rights, curtailment risk, as well as any embedded obligations or restrictions that may limit future value creation (for example, grid connection clauses that fix initial capacity and require reapplication before expanding). For data centre assets in planning or redevelopment phases, early engagement with network operators and regulatory authorities may be needed.

The strategic importance afforded to data centres, shown by their designation as critical national infrastructure across the UK and EU, further underscores the imperative for sophisticated energy procurement, integration, and management strategies. These strategies increasingly define data centre asset viability, operational resilience, and ultimately, investment returns.

Investors are well advised, therefore, to evaluate not only current grid arrangements, but also anticipate potential delays and reforms, thereby integrating comprehensive energy assessments into their strategic planning to protect and enhance asset value.

Energy Procurement and Risk-Return Dynamics

Data centre owners and their customers are increasingly seeking to secure access to stable, long-term, and potentially lower-cost electricity through corporate Power Purchase Agreements. PPAs can provide certainty as to price, volume, carbon intensity of the electricity, or other factors, depending on their chosen features. The types of PPA on offer have also increased rapidly.

Electricity cost pass-through arrangements do not diminish the value of PPAs, as tenants evaluate total occupancy costs, which include electricity expenses. By securing fixed, low-emissions energy pricing through PPAs, data centre operators can deliver predictable and competitive power costs to tenants, directly reducing operational risk exposure while strengthening negotiating positions in lease arrangements.

This cost certainty may allow data centre operators to command premium rental rates, reduce vacancy risk, and ultimately enhance underlying asset valuations through improved tenant retention and superior lease economics. Consequently, data centres are now among the most active corporate buyers of PPAs worldwide.

Physical PPAs: Direct Ownership, Maximum Transparency

Physical (or direct) PPAs involve typically 10 to 15-year contracts through which a data centre takes delivery of electricity—and associated Renewable Energy Guarantees of Origin, or equivalent renewable energy certificates—from a specific generator through the grid. These arrangements offer price stability, traceability, and provide some protection against market or policy shifts.

However, under such PPAs, data centre operators (or tenants, depending on who takes responsibility for power procurement) may be required to assume responsibility for grid balancing obligations, transmission arrangements, and supply-demand matching across variable renewable generation profiles.

This operational complexity typically requires engagement with electricity traders or the development of internal capabilities, which introduces the need for specialised personnel and systems infrastructure that extend beyond traditional data centre operations. Regardless, the precision and durability of such arrangements, which increasingly translate into superior financing terms and enhanced asset liquidity, often appeal to institutional investors. Physical PPAs typically assume one of two forms: sleeved PPAs and onsite (or private-wire) PPAs.

Sleeved PPAs: Grid-Delivered with Managed Risk

This type of physical PPA is frequently used in the British market due to regulatory restrictions. Here, a licensed utility intermediates between an electricity generator and a data centre to wrap the supply of electricity, and manage balancing requirements to deliver electricity through the public grid, in exchange for sleeving fees. In some jurisdictions, the utility may also bear wholesale price and volume risks, thereby shielding the data centre operator from market fluctuations and any balancing responsibilities.

As such, sleeved PPAs involve tripartite contractual arrangements between a generator, buyer, and utility intermediary. Properly structured sleeved PPA arrangements can offer a secure route to long-term value and investment certainty, delivering renewable electricity without the capital and regulatory demands of private-wire infrastructure. The challenge with this, though, is the limited direct contractual protection obtained — with recipients more reliant on regulatory enforcement action as a remedy (which is out of their control and can often have significant public policy drivers).

Onsite or Private-Wire PPAs: Enhanced Energy Security at a Cost

Onsite or private-wire PPAs are becoming increasingly common. They involve supplying electricity directly through onsite or dedicated, off-grid lines, which may enable partial or full bypassing of the public grid infrastructure. That dedicated transmission infrastructure can insulate data centres from some grid charges, whilst delivering enhanced price and supply certainty.

Beyond the substantial capital commitments (typically ranging from £2 million to £ 5 million per MW, depending on proximity to the generating site and terrain), private-wire arrangements may involve complex planning consents, grid connection agreements, or environmental impact assessments.

However, those arrangements can afford end-users greater control, including over contractual pricing, generation source, performance accountability, step-in rights, operational oversight, and the delivery of RECs. Ownership of the private wire network is typically transferred to the power company providing and managing the electricity, but there is clearly much more scope for bespoke arrangements here, given it is a private contractual matter.

Virtual PPAs: Financial Hedging with ESG Credentials

Virtual PPAs (also known as synthetic PPAs) involve contracts-for-difference between data centre operators (or tenants, especially in the case of colocation data centre facilities) and renewable generators, whereby those operators or tenants agree fixed “strike prices” for offsite renewable generation, whilst continuing to receive standard grid supply.

The generator then sells physical electricity into wholesale markets. If the market price exceeds the strike price, then the generator will compensate the operator. Conversely, the operator or tenant will pay the generator if the market price falls below the strike price. Operators or tenants can also receive RECs, which they may use to support their sustainability claims.

Virtual PPA structures can therefore provide procurement flexibility by decoupling renewable electricity generation from physical delivery. As such, they can take advantage of low-emissions electricity sources that may otherwise be unavailable due to physical delivery constraints. Other commercial advantages of virtual PPAs may include assisting operators or tenants to finance new renewable generation capacity, hedge against wholesale price volatility, or aggregate sustainability credentials across multiple facilities (or at a portfolio level).

Operators or tenants may increasingly seek to complement virtual PPAs with equity participation in renewable generation assets, which could combine price certainty for their own energy requirements with the potential for direct financial returns from project ownership. While this approach can enhance investment returns, it necessarily introduces additional exposure to construction, operational, and market risks inherent in electricity generation.

There are challenges though. As the actual electricity supplied to the data centre is not physically delivered from the contracted renewable source, a virtual PPA’s sustainability and reputational value relies on tracking and certification of RECs, which may require sophisticated contractual structures and ongoing monitoring.

Operators or tenants may also have to manage basis risk: the possibility that price fluctuations at the electricity generation site may not always align with those in the data centre’s own supply zone. This may introduce discrepancies between expected and actual settlement payments.

Volume risk may pose another challenge, particularly as virtual PPAs tend to settle based on actual renewable generation, rather than data centre energy consumption patterns. Wind and solar projects, in particular, generate variable outputs depending on weather conditions, although data centres themselves require consistent baseload power. Consequently, operators or tenants may end up making substantial payments to renewable generators, while still needing to purchase electricity from utilities at potentially elevated market prices.

Hybrid PPAs: Optimising Resilience and Returns

Hybrid PPAs weave together multiple PPA mechanisms to optimise risk-adjusted returns, while maintaining operational flexibility. These may integrate onsite or private-wire PPAs (increasingly coupled with battery energy storage) for base supply, sleeving for operational adaptability, and sometimes also synthetic PPAs for portfolio-level carbon management. Hybrid PPAs represent layered risk management frameworks that reflect dynamic market conditions, regulatory developments, and business growth trajectories.

Consequently, hybrid PPAs have capacity to capture the distinctive advantages of each procurement model, while mitigating inherent limitations through portfolio diversification. They enable data centre operators to capture the legal and operational strengths of each model, while catering to desired financial and risk profiles, but at increased cost and complexity both for implementation and ongoing management.

Other PPA Considerations

The emergence of buyers’ alliances represent another notable trend. These comprise coalitions of multiple data centres or hyperscale campuses, jointly aggregating load to negotiate more favourable PPA terms. These coalitions can deliver material commercial advantages beyond pricing improvements, including enhanced contract flexibility, improved credit terms, and reduced risk exposure through diversified offtake commitments.

By consolidating purchasing power across multiple facilities, buyers’ alliance participants can also access larger-scale generation projects whilst distributing development risks across a broader participant base.

PPA termination provisions also warrant particular scrutiny, as early termination could expose data centre operators to stranded asset risks and significant costs. Sophisticated investors may increasingly seek to ask suppliers to indemnify data centre operators for losses caused by power outages. However, such provisions are, in practice, unrealistic in cases where there is insufficient competition to persuade the supplier to accept them.

CASE STUDY: Vertical Integration as Competitive Advantage (KKR and Energy Capital Partners)A recent landmark transaction may demonstrate an evolution of data centre investment towards integrated energy infrastructure platforms. KKR and Energy Capital Partners announced a joint venture to develop a 190MW campus in suburban Dallas, committing a total investment of $4 billion, representing one of the largest single-site developments in the world. The partnership leverages KKR’s operational capabilities through CyrusOne (which it co-owns with Global Infrastructure Partners) alongside ECP’s energy expertise (through Calpine, a leading US power producer), creating integration between development, operations, and electricity supply. This structure simultaneously addresses multiple market friction points. By coordinating design, construction, and guaranteed power delivery within a unified investment platform, KKR and ECP will insulate the project from grid connection delays, wholesale price volatility, and supply chain constraints. The campus, which was pre-let to an undisclosed technology corporation, exemplifies how vertical integration transforms project risk profiles, while accelerating deployment timelines. Fundamentally, strategic alliances between infrastructure investors and energy producers can create sustainable competitive advantages. This approach may fundamentally transform data centre developments from traditional real estate assets into dynamic energy infrastructure platforms. Source: Financial Times |

Technology selection

Renewable Energy and Battery Storage Integration

Data centre operators are increasingly deploying direct renewable energy integration as both a pragmatic response to grid constraints, and a sustainability compliance mechanism. This includes onsite solar and wind generation, or co-location with utility-scale renewable projects, to offsite procurement through the public grid. In many countries, this aligns with government policy priorities.

However, renewable energy’s inherent intermittency may compel data centres to secure either backup public grid connections or integrated battery energy storage systems to ensure uninterrupted supply. Furthermore, BESSs may function as energy management platforms, serving dynamic grid assets. Leveraging bi-directional energy flows, BESS units can arbitrage temporal price differentials by discharging stored energy to meet onsite demand during peak periods, while charging during low-demand windows. These systems may also provide grid services, including rapid frequency response, reserve capacity, and real-time balancing services, which can turn data centres into revenue-generating grid stabilisers during periods of supply and demand imbalance. Therefore, BESS integration may strengthen a data centre’s valuation, particularly where grid flexibility is constrained.

Continuing Roles for Conventional Energy

While renewable energy dominates long-term strategic planning, conventional generation technologies retain vital roles in bridging immediate capacity constraints and operational contingencies. For example, gas-fired turbines, particularly combined heat and power systems, can provide rapidly dispatchable electricity to manage short-term demand volatility, while data centre operators develop other longer-term renewable solutions.

However, operators should balance CHP deployment against evolving ESG requirements and GHG accounting obligations. Although these systems may provide operational resilience, their emissions profiles require sophisticated reporting and potentially carbon crediting strategies to maintain investor confidence, as well as compliance with both hard and soft regulatory requirements.

Nuclear as a Long-term Value Option

Novel Generation III+ and IV nuclear technologies, particularly Small Modular Reactors (known as “SMRs”) and Advanced Modular Reactors (known as “AMRs”), may represent potentially promising energy infrastructure options for data centre integration. In particular, SMRs are compact nuclear fission reactor units, typically producing up to 300MW of energy. They are designed for factory-built modularity and rapid onsite assembly. Delivering consistent baseload electricity with minimal GHG intensity, SMR characteristics can align with hyperscale operational profiles, while addressing ESG requirements.

While only China and Russia reportedly operate SMRs at present, over 80 designs are under development worldwide, and the global SMR pipeline has surged by 42%, amounting to approximately 47GW of projects, around 39% of which are specifically designed for data centre integration.

Some major technology companies are already initiating partnerships (for example, with Deep Atomic’s MK60 and NuScale Power’s VOYGR units) and repurposing existing facilities to secure hybrid baseload and cooling capabilities through modular nuclear deployment. The regulatory regimes underpinning these developments are evolving rapidly, with governments such as in the UK and US implementing expedited licensing pathways and targeted investment incentives for pilot SMR developments.

For example, the UK government recently announced plans to reform nuclear regulations to support the co-location of SMRs and AMRs with AI data centres. This regulatory acceleration reflects recognition by some governments of the nuclear sector’s importance for digital infrastructure resilience.

Whilst capital intensity, fuel supply chain development, and design standardisation present near-term challenges, many industry analysts anticipate commercial deployment by the early-2030s. Nonetheless, successful SMR or AMR integration is likely to require sophisticated risk management, in particular given regulatory timelines, development costs, and public acceptance.

Alongside SMRs and AMRs, micro-reactors, which are ultra-compact nuclear units with outputs between 1MW and 20MW, are emerging as potential solutions for campus-scale or remote data centre projects. Pilot programmes in the US suggest that micro-reactors could provide both secure baseload power and rapid dispatch for grid balancing, particularly as licensing pathways evolve. Early adoption could offer strategic advantages in locations where grid connection is severely constrained or where clients require constant renewable energy supply.

Energy Efficiency and Asset Optimisation

Linking Energy Efficiency with Market Attributes

Escalating energy consumption is catalysing other regulatory changes, particularly across the UK and EU, which may fundamentally alter data centre investment risk profiles. For example, in the UK, non-domestic energy use is subject to the Climate Change Levy, which is a carbon tax on electricity and gas bills (currently £0.00775 per kWh). This represents a material operational cost, which will rise to £0.00801 per kWh from April 2026.

However, data centre operators can mitigate these costs through voluntary Climate Change Agreements, which provide a 92% discount on electricity CCL charges, in exchange for meeting sector-specific efficiency targets over a two-year reporting cycle. TechUK administers the CCA scheme for UK data centre operators. The substantial CCL discounts available through these agreements could enhance asset valuations by reducing long-term operational costs, particularly as electricity consumption scales with facility expansion and increasingly intensive computational workloads.

In a similar vein, the revised EU Energy Efficiency Directive mandates reporting obligations in relation to energy consumption, power utilisation, temperature set points, waste heat utilisation, water usage, and renewable energy usage for commercial facilities with power demands of at least 500kW. Its Delegated Regulation sets out more specific information and KPIs that data centre operators must report to the EC.

In conjunction, the EU Taxonomy establishes green finance eligibility criteria. Under its Activity 8.1, data centres may be deemed environmentally sustainable if they satisfy technical criteria specified in the Taxonomy’s Climate Delegated Regulation. These criteria include full implementation of energy-saving practices derived from the revised European Code of Conduct for Data Centre Energy Efficiency, independently audited, and supported by systems to monitor and report sustainability KPIs (such as power and water usage, refrigerant controls, and climate risk vulnerability assessments).

Similarly, the EU Renewable Energy Directive and Green Public Procurement Criteria also prescribe multi-layered performance benchmarks and other compliance obligations that directly connect environmental concerns with market access, financing, reputational standing, and competitive positioning.

Efficiency Metrics as Investment Differentiators

The Power Usage Effectiveness metric, which is measured as a ratio of the data centre’s total energy consumption and IT energy consumption, increasingly functions as an explicit indicator of asset quality. Facilities achieving PUE ratings below 1.2, while demonstrating advanced water usage practices through closed-loop or adiabatic evaporative cooling systems, are reportedly commanding measurable valuation premiums and preferential financing terms. Such performance levels signal operational excellence that investors are increasingly recognising as indicative of lower risk profiles and superior long-term cash flow stability.

The EU Corporate Sustainability Reporting Directive and forthcoming Corporate Sustainability Due Diligence Directive cascade decarbonisation obligations through enterprise supply chains, positioning data centre energy and water efficiency as fundamental to enterprise customers’ own ESG strategies.

Third-party certifications and emerging EU data centre ratings are also establishing objective benchmarks that may, to some extent, influence lease negotiations, investor appetite, and asset liquidity. These credentials facilitate access to sustainability-linked financing, while generating tenant preference from enterprise customers that face their own ESG obligations.

Technological Innovation as Competitive Advantage

Advanced infrastructure technologies are redefining both operational possibilities and investment returns. AI-enabled management platforms are increasingly optimising real-time power and cooling loads, predictive maintenance protocols, and dynamic demand management. These capabilities have potential to generate measurable operational savings, whilst demonstrating technological leadership to institutional investors.

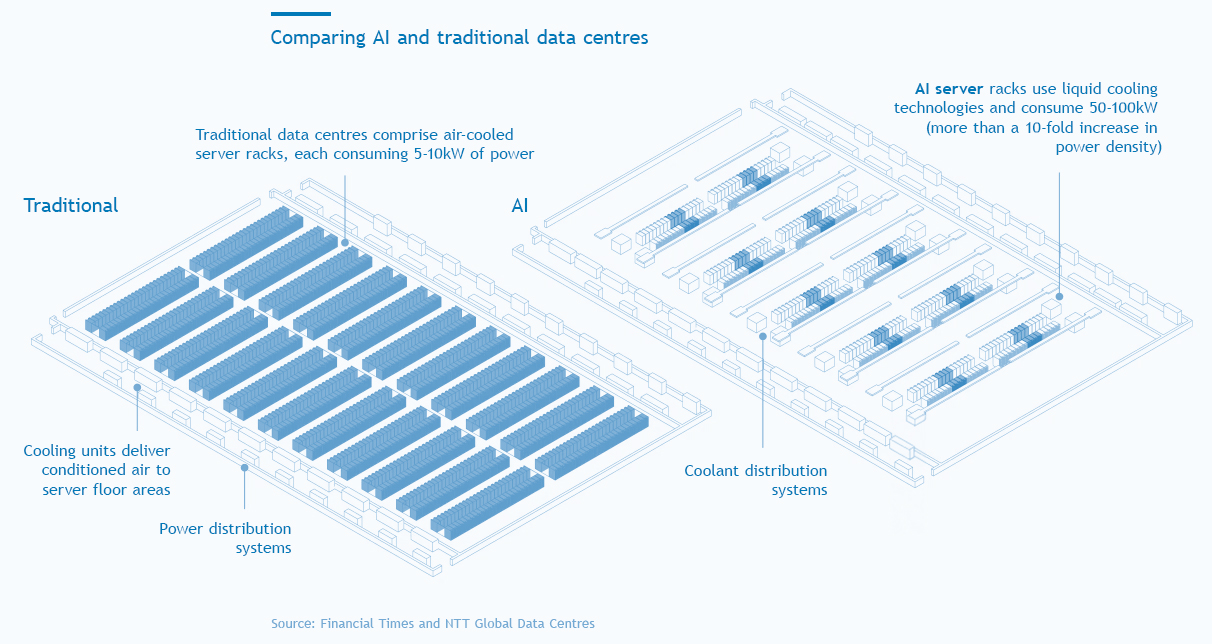

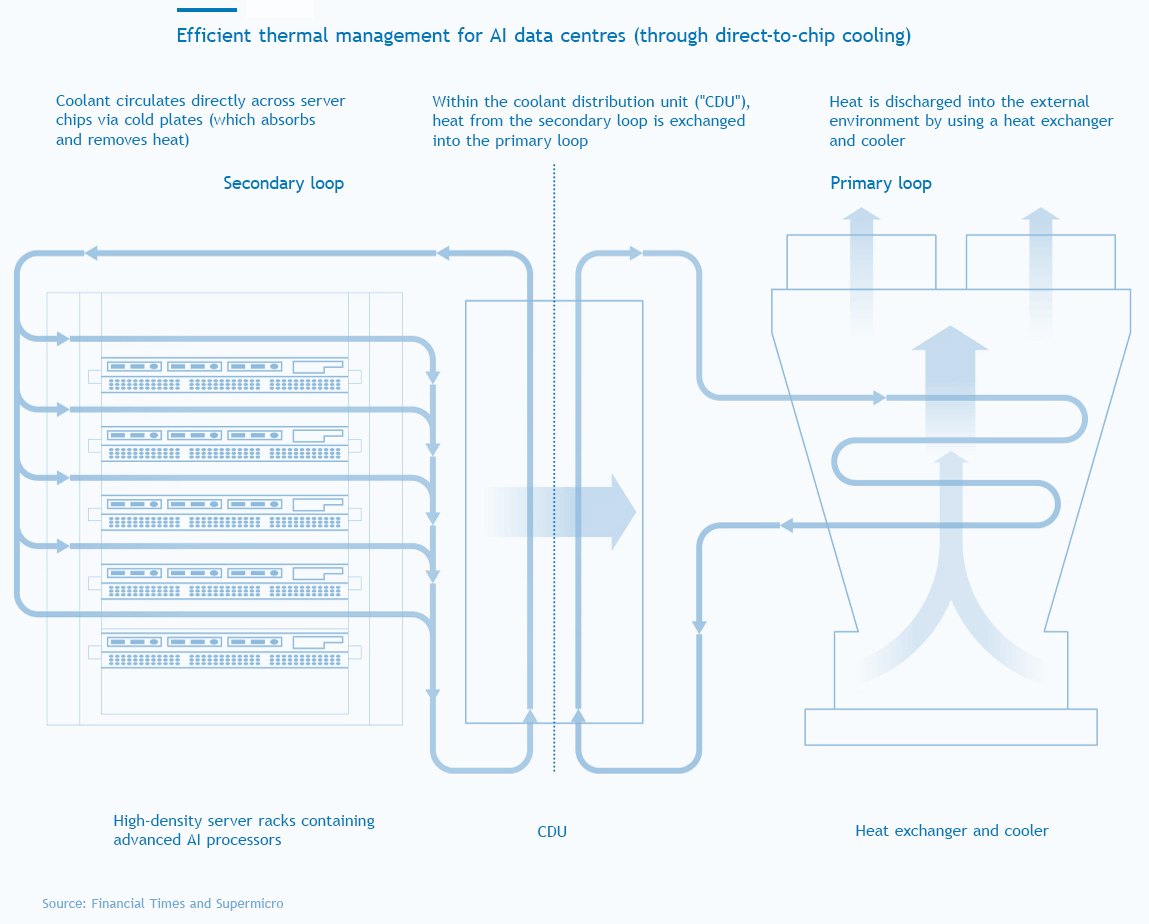

Next-generation cooling technologies, including liquid immersion and direct-to-chip systems, enable unprecedented efficiency gains, with some facilities reportedly able to achieve PUE ratios approaching 1.04. Previously unattainable through conventional air-cooling, such performance levels are creating significant competitive differentiation and operational cost advantages.

In addition, digital twin technologies and intelligent building management systems facilitate more granular energy management practices, enabling dynamic response to fluctuating loads while driving efficiency improvements. These innovations also generate investment returns through reduced total costs of ownership, improved access to green capital markets, and higher asset appreciation prospects.

Conclusion and Implications

The digital economy's exponential expansion repositions energy strategies from operational considerations to principal valuation levers for data centre assets.

As digital demand growth continues to outpace the expansion of traditional infrastructure sectors, more creative and balanced energy strategies are becoming primary differentiators for premium data centre assets. This emerging energy dividend will reward those investors and operators with the right legal and operational toolkit to harness that.

This material is provided for general information only. It does not constitute legal or other professional advice.