Is SAF taking flight?

An overview of the UK's SAF mandate and the next steps needed to decarbonise the aviation sector

Download PDFCurrent SAF Production and Estimated Future Demand

Since the inaugural SAF-powered flight in 2008, and first use of SAF on a commercial aircraft in 2011, SAF demand has experienced consistent growth, with approximately 500,000 flights having operated on fuel mixtures containing SAF to date. Although SAF currently accounts for less than 1% of total aviation fuel consumption, usage doubled in 2023 to over 600 million litres. Industry projections now foresee a sustained acceleration in SAF production, with output in 2025 anticipated to surpass 2.7 billion litres - more than double the actual 2024 figure of 1.3 billion litres - and underscoring the sector’s rapid maturation.

Longer term, the International Air Transport Association (‘IATA’) estimates that SAF usage could account for approximately 65% of the aviation industry’s net zero targets by 2050. The UK government estimates that domestic production of up to 5Mt of SAF annually may be required to achieve the UK’s 2050 net zero target (representing 40% of pre-pandemic aviation fuel consumption of 12.4Mt during 2019). In addition, major airlines, aircraft manufacturers, and corporates are increasingly committing to ambitious SAF targets.

Barriers to Entry

Despite these demand signals, the high capital costs that SAF production projects necessitate currently constrain SAF production, and infrastructure remains limited. Furthermore, production costs remain high. Jet A-1 - the internationally accepted standard for aviation turbine fuel - is currently priced at approximately US$0.05 to US$0.06 per kWh. By contrast, average aviation biofuel prices are currently between US$0.18 and US$0.21 per kWh.

In order to increase SAF production levels, attain economies of scale and reduce prices, substantial further capital investment is required in production capacity and infrastructure for current aviation biofuels. The long-term evolution of synthetic fuels also depends on investors committing the necessary capital for research into technological innovation and extensive production infrastructure.

Facilitating such investment demands a stable, predictable policy framework and clearly articulated long-term targets and demand drivers. In contrast, perceived policy risks could deter sustainable, long-term investment. The coming into force of the UK’s SAF Mandate at the beginning of this year is the result of a multi-year effort by successive governments to provide this predictable policy framework and to increase demand drivers.

Development of the UK Landscape on SAF

Aviation in the UK Emissions Trading Scheme

The aviation sector’s coverage under emissions trading schemes began under the EU Emissions Trading System (‘EU ETS’), which, from 2012, extended its scope to flights from within the European Economic Area (‘EEA’), as well as flights between the EEA and select international routes. This marked the first substantive policy mechanism to apply a carbon price to aviation emissions, thereby initiating efforts to narrow the cost disparity between SAF and fossil-based jet fuel. By assigning an explicit cost to carbon, the EU ETS introduced a market signal intended to internalise the sector’s externalities, albeit one that, in its nascent form, applied only to a subset of routes and with generous free allocation of allowances.

Following the UK’s withdrawal from the European Union, the UK Emissions Trading Scheme (‘UK ETS’) came into force on 1 January 2021, supplanting the EU ETS for UK-covered routes. The UK ETS applies to emissions from domestic UK flights, UK-Gibraltar flights, and flights between the UK and EEA states, covering both commercial and cargo operations above a specified threshold. It retains core design features from the EU ETS - including auctioning of allowances, free allocation, and a cost containment mechanism - while introducing a UK-specific auction reserve price to maintain price stability. Crucially, both schemes treat eligible SAF as a ‘zero-rated’ fuel, meaning that aircraft operators reporting the use of qualifying SAF on a covered route are exempt from surrendering emissions allowances in relation to that fuel. This zero-rating feature provides an early - although partial - economic lever to reduce the effective cost of SAF relative to fossil-based aviation turbine fuel, particularly for operators with material ETS exposure. By aligning fiscal advantage with environmental performance, the ETS has become an important instrument in promoting SAF uptake, capable of complementing direct blending mandates.

Carbon Offsetting and Reduction Scheme for International Aviation

The Carbon Offsetting and Reduction Scheme for International Aviation (‘CORSIA’) was established under the auspices of the International Civil Aviation Organization (‘ICAO’) in 2016 as a global market-based mechanism to address CO2 emissions from international aviation. It aims to stabilise net emissions from the sector at 2020 levels by requiring operators to offset emissions growth above a baseline set at 85% of 2019 emissions through the use of internationally recognised carbon credits. CORSIA entered its pilot phase in 2021, with full implementation scheduled in phases through to 2035. While participation is currently voluntary for most states, it is mandatory from 2027 for all ICAO Member States with significant aviation activity.

As an ICAO Member State, the UK commits to participate in CORSIA and is now considering how best to incorporate this international obligation into UK domestic law. In December 2024, the UK government published a consultation on the incorporation of CORSIA into UK law, with a view to ensuring compliance while maintaining coherence with the UK ETS. The consultation proposes two principal approaches: firstly, a ‘UK ETS-only’ option, which would apply the UK ETS exclusively to flights between the UK, the EEA, and Switzerland, thereby excluding those routes from CORSIA obligations; or secondly, a ‘price-based hybrid’ approach, under which both CORSIA and the UK ETS would apply concurrently to these routes, with operators eligible for financial compensation to mitigate the cumulative cost burden of dual compliance.

Notwithstanding the model adopted, incorporating CORSIA into UK law raises complex legal and policy questions: particularly regarding alignment with existing carbon pricing regimes, the fungibility of offset credits, and the potential for market distortion. Its integration of multilateral offsetting obligations into a sovereign emissions trading framework also marks a significant evolution in international climate governance.

UK Jet Zero Strategy

Acknowledging these policy drivers, the previous UK government unveiled its Jet Zero Strategy (‘the Strategy’) in July 2022, outlining a comprehensive plan to decarbonise the aviation sector. The Strategy foreshadowed a SAF Mandate – requiring that aviation turbine fuel supplied in the UK comprises at least 10% SAF by 2030 – combined with an objective to begin construction of at least five commercial-scale UK facilities by 2025. With these regulatory measures, some analysts surmise that SAF projects could deliver internal rates of return akin to those historically observed in the oil and gas sector, typically ranging from 6% to 17%.

UK Renewable Transport Fuel Obligation

Alongside this, the UK Renewable Transport Fuel Obligation (‘RTFO’) entered into force in 2008, and explicitly recognised SAF an eligible fuel under the scheme from 2018, before the SAF Mandate amended the RTFO’s scope to exclude aviation turbine fuel. Under the RTFO framework, fuel suppliers had to ensure that a designated percentage of the fuel they supplied was derived from renewable or sustainable sources. The RTFO further established a development fuels sub-target to stimulate the use of renewable fuels of non-biological origin (such as electrolytic hydrogen and renewable e-fuels).

UK SAF Mandate: Obligations and Mechanisms

The SAF Mandate came into force on 1 January 2025 and applies to all UK aviation turbine fuel suppliers delivering at least 15.9 terajoules (approximately 468,000 litres) per calendar year (‘fuel suppliers’). Under the SAF Mandate, these fuel suppliers are required to blend certain minimum levels of SAF with conventional, fossil-based aviation turbine fuel.

The SAF Mandate comprises five primary components: a ‘main obligation’ to drive emissions reductions through SAF utilisation; a cap on SAF derived from Hydroprocessed Esters and Fatty Acids (‘HEFA’); a minimum power-to-liquid (‘PtL’) fuel obligation; robust sustainability criteria; and the introduction of a buy-out price. We analyse each of these mechanisms in detail below.

Main Obligation

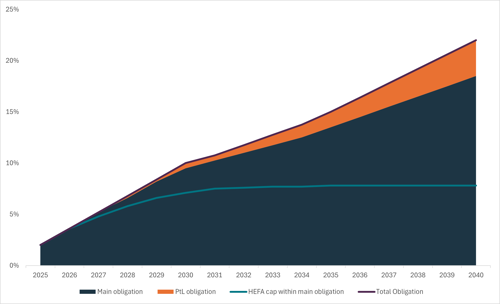

The main obligation imposes escalating SAF supply obligations on fuel from 2025 to 2040. For 2025, fuel suppliers must ensure that SAF comprises 2% of the total aviation turbine fuel they supply in that year. Each supplier’s obligation is calculated in terms of total energy content — rather than fuel mass or volume — thereby accounting for differences in energy density. This annual target increases to 10% by 2030, 15% in 2035, and 22% in 2040 (refer to Figure 1 for each annual obligation from 2025 to 2040). In the Department of Transport’s (‘DfT’s’) estimation, these targets balance the need for long-term investment certainty in the UK’s SAF demand with the flexibility required to accommodate ongoing technological and commercial developments, whilst upholding ambitious environmental standards.

HEFA Cap

HEFA represents the key commercial-scale SAF production pathway currently available. Although HEFA qualifies as an eligible SAF under the main obligation, the government will cap the volume of HEFA eligible for incentives under the SAF Mandate. Initially, the HEFA cap begins at 100% for 2025 and 2026, then decreases to 92.31% in 2027, declining incrementally each year until the cap reaches 42.16% in 2040. This measure intends not only to encourage investment in a more diverse portfolio of advanced SAF technologies, but also mitigate the premature diversion of HEFA from its vital role in the road transport sector. Importantly, the cap restricts only the volume eligible for support under the SAF Mandate, not the total production of HEFA in the UK, acknowledging that the finite nature of its feedstocks faces global competition from other transport sectors.

Power-to-Liquid Obligation

Complementing the main obligation, the SAF Mandate introduces a dedicated requirement to supply PtL fuels, defined as low-carbon aviation turbine fuel synthesised from renewable (excluding biomass) or nuclear power. From 2028, the SAF Mandate will impose a PtL obligation of 0.2% of the total quantity of aviation turbine fuel that each supplier delivers in a given calendar year, escalating to 0.6% in 2030, and reaching 4.5% by 2040. It requires PtL suppliers to demonstrate that the renewable electricity consumed in the fuel’s production represents genuinely new or surplus generation, rather than diverting existing low-carbon supply from the grid. Suppliers must also demonstrate that their electricity qualifies as ‘additional eligible energy’, proving that it would not have been generated, or would otherwise been curtailed or wasted, without consumption by the PtL production site.

Sustainability criteria

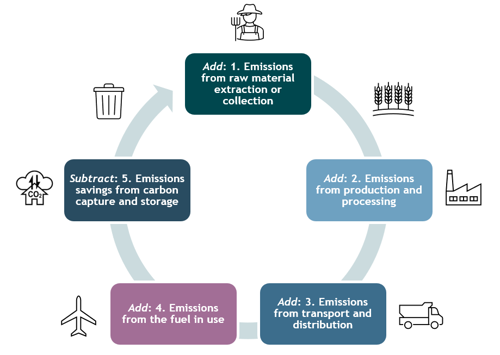

To qualify for eligibility under the SAF Mandate, fuels must satisfy specified sustainability benchmarks, principally achieving a minimum greenhouse gas emissions reduction of at least 40% when compared to a fossil-based aviation turbine fuel baseline of 89gCO2e/MJ. This calculation employs a lifecycle methodology, consistent with the established approach under the RTFO (refer to Figure 2 for further detail). In setting these thresholds, the government sought to strike an appropriate balance between driving immediate substantive emissions reductions and enabling the inclusion of emerging fuel pathways, which may currently exhibit higher emissions, but hold substantial future decarbonisation potential. To maintain momentum towards deeper decarbonisation, the government anticipates progressively raising this GHG reduction threshold. While precise timings and increments for these increases remain under consideration, the government has stated it is committed to an evidence-based, phased approach that responds dynamically to market developments and technological advancements.

Furthermore, the SAF Mandate excludes SAF derived from food and feed crops, reflecting broader concerns over food security, land use pressures, and environmental sustainability. This exclusion aligns with the government’s objective to prioritise waste-based and advanced feedstocks, thereby fostering more resilient and socially responsible supply chains. Eligible SAF must conform to international technical standards — including, but not limited to, ASTM D7566 — which governs fuel composition, performance, and safety of synthetic fuels. Certified SAF may be blended with conventional, fossil-based Jet A-1 aviation turbine fuel in proportions of up to 50%, in accordance with ASTM D1655 specifications for aviation turbine fuel.

Buy-out mechanism

Where physical blending proves uneconomic, suppliers may discharge their SAF Mandate liabilities at fixed buy-out prices of £4.70 per litre against the main obligation, and £5.00 per litre for PtL volumes, by 26 October in the year following the obligation period. Explicitly conceived as a temporary price ceiling, rather than a permanent penalty, these buy-out rates exceed projected SAF costs to channel market behaviour towards genuine SAF procurement. As SAF production scales, and blending costs decline over time, the government envisions that market logic will steadily relegate the buy-out to an unattractive contingency, reinforcing its role as a short-term safety valve.

Compliance and Operational Mechanisms

Point of Obligation

Under the SAF Mandate, suppliers of aviation turbine fuel are assessed at the appropriate “duty point”: the precise moment when fuel volumes are recorded for auditing, taxation, and compliance purposes. For domestically produced fuel, this is typically when it departs the production facility; for imported fuel, upon its arrival at the UK storage facility; and for hydrogen, when it is sold to a customer for use in aircraft or testing aircraft engines.

SAF Certificate Types and Allocation

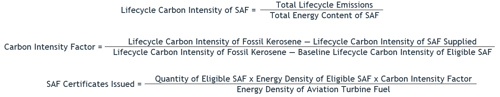

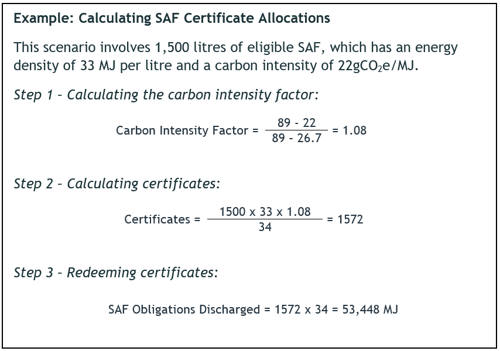

The SAF Mandate distinguishes between Main Obligation SAF Certificates — awarded for delivering qualifying SAF in proportion to its energy content and lifecycle emissions performance — and PtL Certificates, which are issued solely for PtL fuel to track compliance with the dedicated PtL sub-quota. Main Obligation Certificates may also cover eligible aviation gasoline or hydrogen. By linking certificate allocations to both energy supplied and a carbon intensity factor — calculated against DfT default values for energy density of 34MJ per litre, fossil aviation turbine fuel lifecycle carbon intensity baseline of 89gCO2e/MJ, and a SAF lifecycle carbon intensity baseline of 26.7gCO2e/MJ (which is equal to 70% emissions reductions relative to fossil kerosene) — the scheme rewards lower-emissions, higher-energy fuels with greater certificate yields (refer to Figures 2 and 3). The greenhouse gases included for the purposes of these calculations are CO2, N2O, and CH4.

Validation and Record-Keeping

To ensure integrity and prevent double counting, suppliers must retain comprehensive mass-balance chain-of-custody and sustainability data for every SAF consignment. An approved, independent third-party verifier must certify that all SAF sustainability criteria have been met, and quantities supplied are accurate, before the DfT issues certificates. Furthermore, suppliers must demonstrate that neither the SAF, nor its precursors, have received benefits under any other UK or international support scheme (such as feed-in tariffs or premium payments).

Discharging Obligations

Aviation turbine fuel suppliers must report to DfT on a monthly basis the quantities of all fuel — including SAF — that they supply. At any time up to 14 May in any given year, suppliers must apply for SAF Certificates to be issued to them covering the preceding calendar year. These certificates may then be redeemed by 15 September, or the supplier may discharge its obligation by paying the buy-out price by 26 October in that same year (in respect of its obligations in the prior year). The SAF Mandate defines each supplier’s annual main obligation as a percentage of the total notional amount of aviation turbine fuel the supplier delivers over the year. If a supplier’s total falls below 344 terajoules, the first 15.9 terajoules — the Mandate’s threshold — is deducted before applying the percentage. Suppliers may trade SAF Certificates or carry forward up to 25% of their annual obligation to meet obligations in the following year.

Penalties

Where a supplier breaches its reporting obligations under the regime, the regulator may impose a civil penalty capped at the lesser of £100,000 or 10% of turnover derived from fuels covered by the SAF Mandate. However, failure to comply with the main obligation or PtL obligation triggers a distinct financial consequence: the supplier must pay the applicable buy-out amount by the statutory deadline. Unlike reporting penalties, which are capped and proportionate, the buy-out payment is uncapped and calibrated directly to the supplier’s outstanding obligation. Non-payment of the buy-out amount by the deadline may also attract interest and enforcement action. This structure reinforces a clear hierarchy: technical reporting failures attract limited sanctions, whereas substantive failures to deliver SAF volumes or pay the buy-out in lieu expose suppliers to material, escalating financial exposure.

SAF Revenue Certainty Mechanism and Industry Levy

Scaling Challenges and Investment Imperatives

The SAF Mandate’s effectiveness will hinge on the sector’s ability to scale production rapidly and sustainably. Notwithstanding the strong demand signal that the SAF Mandate provides, material concerns persist across the industry regarding the feasibility of achieving the uplift in SAF volumes necessary to align with the UK government’s target trajectory. Reliance on HEFA-based fuels — though commercially proven — is inherently constrained by finite feedstock availability and competing demands from other sectors. As the SAF Mandate progressively tightens the cap on HEFA-derived fuels, the imperative to accelerate the commercialisation of advanced pathways — such as PtL and alcohol-to-jet technologies — becomes increasingly acute. Without sustained investment and technological maturation, meeting the higher-end blending obligations of the 2030s and 2040s risks becoming unattainable. Addressing this challenge will require not merely capital mobilisation but coordinated public-private efforts to de-risk innovation, expand production capacity, and secure resilient supply chains.

Revenue certainty mechanism

Against the backdrop of scaling imperatives and supply-side constraints, it is evident that regulatory demand alone will not suffice. Ensuring the bankability of SAF projects will require complementary measures to stabilise revenues and de-risk early investment. The high capital cost of SAF production facilities — with government estimates suggesting costs between £600 million and £2 billion to achieve economies of scale — combined with the substantial price differential between SAF and fossil-based aviation turbine fuel, underscores the need for further targeted support. The SAF Mandate alone does not address this issue: it creates an obligation to supply SAF but neither establishes a guaranteed market price, nor shields domestic producers from global production fluctuations or external price pressures.

In this context, securing affordable finance for SAF projects remains challenging. Perceived regulatory and revenue uncertainty, coupled with intense competition for capital from other low-carbon technologies, heightens the risk premium attached to SAF investments. Without additional mechanisms to stabilise project revenues and reduce investor exposure to price volatility, many SAF developments would struggle to achieve financial close at commercially viable terms.

Guaranteed strike price

Recognising these dynamics, the government has consulted extensively with industry over the past two years on the design of a bespoke revenue certainty mechanism, with a stated aim of enacting the necessary legislative framework by the end of 2026. Building on the proven model of contracts for difference (‘CfDs’) in the renewable electricity sector, the government has confirmed that the mechanism will operate on a ‘guaranteed strike price’ basis, ensuring that SAF producers are remunerated at a predetermined price per litre of fuel supplied. Implementation will proceed through private contracts between producers and a government counterparty, expected, although not yet formally confirmed, to be the Low Carbon Contracts Company (‘LCCC’).

This mechanism is based on an established precedent used for both renewable and (previously) nuclear projects and is now being deployed for hydrogen projects. Both the government and the majority of industry stakeholders felt that it was the model most likely to deliver credible, bankable revenue streams, and the highest level of investor confidence. It should be noted that the government has clarified that the first tranche of contracts signed under the revenue certainty mechanism will be limited to non-HEFA SAF production only.

There are a number of critical policy decisions to be taken in respect of the design of the SAF CfD. One of the most important relates to what to use as the ‘reference price’. A fundamental basis of a CfD is that it pays a difference payment bridging the gap between a pre-agreed strike price and a market reference price; it provides the revenue certainty of topping a producer up from a price which it should be able to achieve by selling its product in the (potentially volatile) market. For the renewables CfD, this is simple: there is a well-established, independently published market reference price for electricity. For SAF, this is not the case: the market is far more nascent than the power sector.

The government faced similar challenges in relation to the Low Carbon Hydrogen Agreement (‘LCHA’) and decided that the reference price should be set at the price that producers are actually able to sell hydrogen for (the achieved sales price). This is one of the preferred options for the SAF CfD. If that is the case, there are two follow-on design features which are critical to address the resultant incentive issue (that is to say, a producer has no incentive to sell SAF at anything above a nominal price if they are always topped up to the strike price).

- Firstly, the revenue certainty mechanism would need to set a floor price which SAF producers know they could attain. Whilst the fossil-based aviation turbine fuel price would appear to be the most obvious floor price — following the logic of using the gas reference price as a floor price for hydrogen — the government will need carefully to consider whether this level is appropriate, especially in the context of likely competition from imported SAF and the difficulty of finding offtakers willing to pay a variable price on a long-term contract.

- Secondly, the government needs to ensure that SAF producers are incentivised to sell SAF for prices above the floor price. Under the hydrogen business model, producers are permitted to keep 10% of any price achieved above the floor price as a ’price discovery incentive’. We would expect a similar mechanism to be included. In practice, it remains to be observed whether these incentive structures will be sufficient to secure robust offtake pricing. For example, some producers may be willing to accept the floor price in exchange for concessions on other offtake terms (such as in relation to liability regimes) and forego the 10% incentive payment: clearly, the risk of that occurring lessens if the incentive percentage is set at a higher level.

Another critically important policy decision will be how the strike price is adjusted. There are numerous options here (for instance, indexing a portion of the strike price to relevant feedstock prices — which will differ for various pathways — or energy costs, or simply indexing everything to CPI: as for green hydrogen and renewables projects). There is a balance to be struck: whilst DfT may be reticent for LCCC to be exposed to an increase in feedstock prices (in the same way that DESNZ has been unwilling for LCCC to be exposed to increases in power prices for green hydrogen projects: see more here), the alternative could ultimately be more expensive if producers look to reflect this in very expensive, long-term, fixed-price feedstock contracts or a higher cost of capital (both of which will translate to a higher initial strike price).

Fundamentally, clarity over the revenue support structure will serve as a precondition for unlocking institutional capital, particularly from infrastructure funds and impact investors whose mandates hinge on predictable cash flows and regulatory stability. In this respect, we might view the revenue certainty mechanism not merely as a subsidy, but as a structural market reform intended to internalise environmental externalities and provide long-term price certainty for an emerging commodity.

Funding the revenue certainty mechanism

In March 2025, the government published a consultation in relation to how the revenue certainty mechanism will be funded, having previously promised the scheme would be ‘industry funded’. In line with the ‘polluter pays principle’ set out in the Environment Act 2021, it is currently contemplated that the revenue certainty mechanism will be funded by a variable levy on the same aviation turbine fuel suppliers — of which the government estimates there are around 20 in total — that are obligated under the SAF Mandate. The relevant fuel suppliers will pay differing amounts depending on their respective market shares and the payments required are likely to vary over time depending on the price of non-HEFA SAF.

The government’s rationale for funding the levy from high up the supply chain is that the cost will be shared between airlines, freight companies and passengers. The government has sought to reassure fuel suppliers that the requirements for funding will only be modest (the consultation projects that a worst-case scenario would require £10 billion in subsidies to producers over 15 years) and that fuel suppliers will benefit from the likely increase in supply — and resultant reduction in cost — of SAF as a result of the subsidy scheme.

International Comparison of SAF Policies

Governments worldwide are also actively establishing measures to accelerate SAF deployment. In the EU, the ReFuelEU Aviation Regulation mandates steadily increasing SAF blending requirements, starting at 2% in 2025 and rising to 70% by 2050. Unlike the UK’s approach, which permits suppliers to discharge shortfalls through a predefined buy-out payment, ReFuelEU imposes direct obligations on fuel suppliers — together with certain operational requirements on airports and airlines — and enforces compliance through monetary penalties.

While both regimes impose financial consequences for failures to meet blending targets, their legal character diverges. The UK’s buy-out mechanism operates as an ex ante compliance alternative, deliberately priced to incentivise physical SAF uptake, while providing a predictable ceiling on non-compliance costs. By contrast, ReFuelEU Aviation treats blending as a strict legal obligation: non-compliance triggers an ex post enforcement penalty, with no structured alternative to achieving the mandated volumes. This structural distinction reflects a broader difference in regulatory philosophy between the two regimes, balancing flexibility and deterrence in contrasting ways.

In addition, the EU and UK regimes’ SAF eligibility criteria diverge in several material respects. ReFuelEU Aviation imposes higher lifecycle emissions reductions of 65% for biofuels and 70% for PtLs, compared to the UK’s 40% minimum standard. Feedstock eligibility also differs: the EU restricts eligible feedstocks to a narrower range of inputs than the UK. Certification requirements further diverge, with the UK relying on domestic verifiers and the EU mandating recognition under approved voluntary schemes. The EU also enforces a 90% minimum uplift requirement to mitigate tankering risks, a measure absent from the UK’s framework.

Furthermore, ReFuelEU Aviation does not establish a certificate trading scheme. Compliance under ReFuelEU is demonstrated directly through verified records of physical SAF supply and sustainability certification, without the creation of tradable surplus credits. Finally, both the EU and UK regimes require certain synthetic SAF production facilities to comply with temporal correlation requirements. This means those facilities must match the facility’s renewable electricity consumption with renewable energy supplied exclusively to the specific facilities, although EU requirements remain less restrictive than those applicable in the UK. These differences have practical implications for cross-border SAF supply chains and project structuring.

In North America, the US Inflation Reduction Act has established significant incentives to catalyse SAF production. Until the end of 2024, a dedicated tax credit under section 40B offered a base rate of US$1.25 per gallon, increasing to a maximum of US$1.75 per gallon for SAF achieving lifecycle emissions reductions exceeding 50% relative to fossil-based aviation turbine fuel. From 1 January 2025, this regime transitioned to the Clean Fuel Production Credit under section 45Z, which offers a base credit value of US$0.35 per gallon of SAF produced. This amount escalates to a maximum of US$1.75 per gallon when prevailing apprenticeship and wage requirements are satisfied, and the fuel achieves the lowest carbon intensities. The credit value is further adjusted based on the fuel’s CO2 emissions factor and annual inflation rates. Separately, California’s Low Carbon Fuel Standard (‘LCFS’) and British Colombia’s LCFS incentivise SAF production by enabling the issuance and trading of compliance credits to achieve carbon intensity benchmarks.

At the global level, CORSIA remains in its voluntary phase until the end of 2026, and covers around 60% of total international aviation emissions. CORSIA’s sustainability criteria — as specified by ICAO — differ slightly, but materially, from those under ReFuelEU Aviation and the UK SAF Mandate. For instance, CORSIA accepts a wider range of eligible feedstocks, including certain crop-based materials. Its lifecycle emissions threshold is also less demanding, requiring a minimum 10% reduction relative to fossil-based aviation turbine fuel.

Yet, while international schemes diverge in their sustainability criteria and enforcement mechanisms, a common structural challenge persists: how to match regulatory ambition with SAF distribution and availability. With this, governments may need to consider the deployment of ‘book-and-claim’ mechanisms to complement physical SAF deliveries. By decoupling the environmental attributes of SAF from its physical movement, book-and-claim models could offer flexible, cost-effective pathways for operators to meet compliance obligations, even where direct SAF supply is unavailable. If properly calibrated, such mechanisms can preserve environmental integrity — ensuring rigorous verification of emissions reductions — while expanding access to SAF markets globally. Furthermore, aligning book-and-claim standards with international frameworks could enhance certificate fungibility across jurisdictions and mitigate the risk of regulatory arbitrage.

Conclusion and Implications

The UK SAF Mandate’s introduction signals a decisive step forward in the UK’s ambition to decarbonise aviation, offering clarity and predictability for stakeholders across the aviation turbine fuel supply chain. While challenges undoubtedly remain — particularly relating to price certainty, supply chain maturity, and international competitiveness — the SAF Mandate represents a sophisticated regulatory approach, balancing ambition with pragmatism. As governments worldwide implement comparable policies, industry players must contend with an increasingly intricate regulatory landscape. Yet, those positioning themselves strategically could leverage significant opportunities in the emerging SAF market. Ultimately, the SAF Mandate’s effectiveness will depend on robust policy coherence, continued innovation, and targeted financial support mechanisms to ensure the UK’s aviation sector is not merely compliant, but indeed a global leader in the net zero aviation journey. In this respect, it will be critical for the UK government to strike the right balance with the revenue support mechanism being crafted for SAF production projects, and industry players will want to ensure they are poised to continue to input and shape the development of these mechanisms.

This material is provided for general information only. It does not constitute legal or other professional advice.