Regulated Asset Base Models: Their role in energy and infrastructure investment in the UK

Executive Summary

To support the energy transition and rising investment needs in infrastructure, the UK government is expanding its use of Regulated Asset Base (RAB) models. RAB models are intended to attract private capital by offering stable, regulated returns over time, reducing the risk of long-term infrastructure investment. RAB models have been traditionally used in the water and energy sectors, but their use is expanding to major, new-build projects, such as the Sizewell C nuclear power plant and the new Lower Thames Crossing, as well as new pipeline networks for carbon dioxide transportation and storage, and hydrogen.

Key to a RAB model’s operation is confidence in the relevant sectoral regulator. The regulator oversees the price control process and the issue of sector-specific licences that underpin expected investor returns. In determining the economic outcomes of the RAB model, regulators must balance several competing objectives, established in the relevant legislation. These typically include consumer protection but have expanded over recent years depending on the sector to include objectives such as the achievement of climate goals. The relevant regulator’s ability to manage these competing objectives is therefore important for the functioning of the framework. The extent to which the relevant regulator can do so also depends on the coherence of the wider legal framework.

Under traditional RAB models, investors will receive revenue during the operational period. However, licences for some large-scale, new build developments—such as the Thames Tideway Tunnel and Sizewell C nuclear power plant — allow investors to receive revenue during construction. This lowers the cost of capital, which ultimately results in greater value for money for consumers and taxpayers.

Although RAB models share similar aims and characteristics, material differences can be observed in their design, the duties and approach of the relevant regulator, the applicable dispute resolution mechanics as well as in the levels of public interest they attract. As a result, investors are advised to undertake a detailed assessment of the relevant reforms proposed to existing RAB models and/or new models developed to ensure the appropriate balance is achieved.

The Regulated Asset Base (RAB) model is a tried and tested method used in the UK to finance major infrastructure assets. The model aims to strike a balance between delivering value for money to consumers and providing long-term stability for investors. For novel, capital-intensive development projects the RAB model can be tailored to achieve a lower cost of capital. By consumers paying a small amount extra on their bills during the construction period, the model avoids the build-up of interest on loans which would otherwise mean higher bills later. This article – produced for the Global Infrastructure Investor Association by Slaughter and May – examines the future potential for the RAB model, how it works, the role of regulation to protect the consumer interest, and what it all means for infrastructure investors.

Introduction

With significant investment required in new and existing infrastructure, the UK government is increasingly looking to RAB models to attract long- term capital into the energy and infrastructure sectors. The UK has a long history of using RAB models to support the delivery of core utilities. With RAB models now being deployed in relation to new sub- sectors, this article considers some of the key features of those models, how they are evolving to support greenfield developments, and the risks associated with the RAB concept.

Where are RAB models used?

The UK has relied on the private sector for the delivery of monopolistic energy and infrastructure networks since the privatisation of water, electricity and gas systems in the late 1980s. As a result, the government has used economic and regulatory levers to incentivise delivery of key infrastructure and critical public services. RAB models provide stable, regulated returns for operating and investing in these networks, whilst protecting consumers from market power dynamics. As such, they have been central in funding core infrastructure since privatisation.

For example:

- In the power sector, transmission and distribution network price controls use a RAB model. Other models are also used to incentivise investment in electricity network infrastructure. For example, investors will be familiar with the Offshore Transmission Owner regime where bidders compete to acquire, operate and maintain (traditionally generator- built) offshore transmission assets, and are awarded a licence entitling them to a regulated, inflation-linked revenue stream. A similar model is proposed for early competition in onshore transmission under the Competitively Appointed Transmission Owner regime. Interconnectors connecting third countries with Great Britain are - and the first pilot projects for Offshore Hybrid Assets will be - supported by another different type of regulatory investment model. In this case the regulator sets a cap and floor for revenues at a level designed to mitigate the asset owner’s exposure to market risk.

- A RAB model is used in the UK water sector, which has been the subject of significant scrutiny as part of the Independent Water Commission’s review into the sector. Whilst its final recommendations include changes to the price review parameters and process, the Commission’s view is that reforms should seek to attract long-term, low-risk investors into the sector by continuing to use the RAB model. For details of the Commission’s final report and its recommendations for reforms, please see our briefing here.

- Beyond these core utilities, a RAB model is used for Heathrow airport, due to its market power, and for standalone social infrastructure investments such as the Thames Tideway Tunnel super-sewer.

- We are also now seeing a renewed use of novel RAB models to support new investment including in particular:

- the Lower Thames Crossing, a road tunnel connecting Kent and Essex

- the new Sizewell C nuclear power plant

- carbon dioxide transportation and storage networks

- hydrogen pipeline networks

In circumstances where the RAB model is seeking to deliver novel assets which are subject to risks that the private sector would not be in a position to manage, the RAB regime may be combined with a government support package or other risk mitigation.

How does a RAB model work?

Central to any RAB model is the price control / review process which takes place periodically throughout the term of the licence. At each review, an economic settlement is agreed with the regulator. The settlement provides an allowed revenue depending on the achievement of certain performance incentives and outcomes.

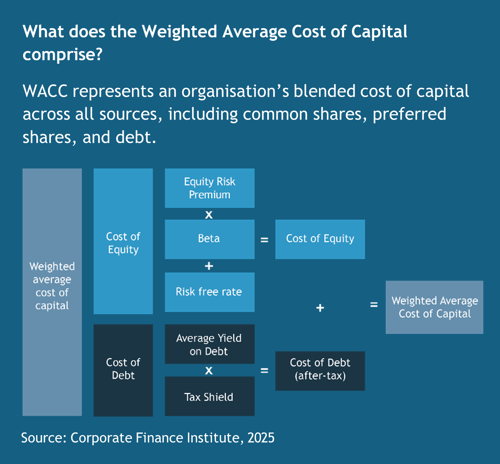

For capital expenditure (capex) invested in new assets, the allowed revenue includes a return of and on capital invested over the lifetime of the asset. Allowed revenue tends to be built-up from a number of building blocks, including the return on capital invested, allowances for operating costs and depreciation, and adjustments for performance and uncertainty mechanisms. The depreciation allowance entitles the asset owner to recoup its capital investment (return of capital) overtime, spreading the cost of the asset or network over current and future consumers or users (depending on the scheme). The return on capital is calculated by applying a weighted average cost of capital (WACC) to the asset base (see box). Allowed revenues are frequently adjusted according to certain incentives (for example, to incentivise performance or to minimise expenditure by enabling cost savings to be retained in part).

The role of the regulator

Underpinning RAB models is the role of the regulator. The investability of any RAB model is predicated in the confidence that investors have in the regulator to approve an economic settlement that allows stable levels of return on committed capital. This is usually at a level commensurate with the lower risk of these assets, whilst also ensuring value for money for bill payers.

Regulators are independent from but generally work with the sponsoring government department to oversee the delivery of public infrastructure by the private sector. Whilst regulators implement policy set by government, their independence provides greater stability and objectivity in decision-making as they are largely insulated from the political election cycle and prevailing political influences.

Whilst regulators are usually appointed under legislation, RAB models are rarely directly mandated in statute. Instead, their legislative basis often derives from the power of the relevant regulator to award licences in respect of a regulated activity and to set the conditions of these licences. As a result, RAB models are often established within the licence and supplemented by supporting guidance developed by the relevant regulator. There are, naturally, variations in this approach. For example, the Nuclear Energy (Financing) Act 2022 empowers the Secretary of State (rather than the regulator) to modify the new nuclear power plant’s generation licence to provide for a new RAB model.

As a result, there is often a wide discretion for the relevant regulator (or government, depending on the licensing regime) to determine the terms of the RAB model. The framework for exercising this discretion is delineated by statute. Both the Secretary of State and the relevant regulator are usually required by statute to consult on proposed licence conditions, and to exercise their powers in accordance with certain duties. Please see the box for an example of how this applies in the energy sector.

How does Ofgem exercise its functions?For gas and electricity networks, Ofgem is subject to a principal objective to protect the interests of consumers in relation to gas and electricity conveyed through these networks. This forms the basis for its role in promoting competition and achieving value for money for consumers. Recent amendments to legislation in 2023 have clarified that this obligation also encompasses consumer interests in achieving climate goals and security of supply. In the exercise of these functions, regulators also must also have regard to matters such as the need for companies to be able to finance their regulated activities. |

Certain regulators such as the Civil Aviation Authority, Ofcom, Ofgem and Ofwat are also under a statutory requirement to have regard to the desirability of promoting economic growth under the Deregulation Act 2015 (alongside other duties set out in the relevant licensing regimes). The government provides additional direction to regulators by setting policy priorities, publishing strategic policy statements and providing direction on certain issues where they are empowered to do so by legislation. In this context, the Government’s 10 Year Infrastructure Strategy sets a new expectation and new approach to infrastructure investment in the UK, focused on growth (something which the GIIA has advocated should be included within regulatory duties). The newly constituted National Infrastructure and Service Transformation Authority will play a role working with government and the relevant regulators to improve infrastructure delivery and coordinate future investment, implementing the strategy.

The relevant regulator’s ability to manage these competing objectives is therefore important for the functioning of the framework. The extent to which the relevant regulator can do so also depends on the coherence of the wider legal framework. For example, Sir Jon Cunliffe, in the interim report of the Independent Water Commission, found that public trust in the water industry in England and Wales had been undermined observing “The reasons for this are complex, interlocking and have emerged over time. They include issues concerning capacity and capability of the regulators, the complexity of the underlying legislative framework, the interaction of conflicting remits and drawbacks that have become apparent in some of the regulatory approaches that have been pursued”.

Incentivising new infrastructure investment

Where RAB models are used for greenfield construction projects, the licence will include provision for the assessment of capex incurred. Addition of capex costs to the asset base will, in general, only be permitted where they are efficiently incurred. This assessment may take place ahead of construction, and/or afterwards. Frequently, pre- construction assessment is used where the licensed network owner is required to take construction risk and to deliver the works at or under budget.

However, for novel projects or those with long construction lead times, elements which cannot be known at the time of the price control may be subject to a post-construction assessment. In addition, a risk-sharing regime may apply in respect of cost overruns and savings. For example, in relation to carbon dioxide transportation and storage networks, 40% of any cost overrun, in addition to the construction allowance, is added to the asset base and 60% of any saving below the construction allowance is logged to the asset base. Re-openers are also permitted in relation to events outside of the operator’s control such as force majeure.

In some models, the allowed revenue is only payable during the operating phase of the network and any return on capital during the construction phase is capitalised and added to the RAB. However, some RAB models applicable to new build assets may allow payments during construction, particularly in circumstances where construction periods are lengthy. This lowers the cost of capital for the project, which ultimately results in greater value for money for consumers and taxpayers. This was the case for the Thames Tideway Tunnel and will also apply to the Sizewell C nuclear power plant.

The means of revenue collection also varies in these new build assets. Some models, such as for Sizewell C, provide a right to an allowed revenue but no actual revenue is provided under the licence. Revenues are, instead, earned in the market from the sale of electricity. However, the project’s revenues are supported by a revenue collection contract entered into with the Low Carbon Contracts Company (LCCC), a company wholly-owned by the UK government, which is a contract for difference settled by reference to forecast market revenues. For further details, see our briefing here.

Other models guarantee payment up to the allowed revenue (albeit subject to performance incentives) and require repayment of amounts recovered exceeding the allowed revenue. An example of the latter is the regulatory investment model for initial carbon dioxide transportation and storage networks in the UK. Network owners are entitled to recover an allowed revenue via charges levied on network users, but they also benefit from a revenue support agreement entered into with the LCCC. This agreement tops up user fees if these fall below expected levels without the need to wait for mutualisation under the RAB model. This reduces both demand risk and operational risk (subject to the application of an availability incentive). These interventions can provide value for money by reducing uncertainty surrounding the demand for services or market price risk and so reducing the cost of capital.

Disputes

By contrast with other schemes such as the contract for difference for renewables, a licence is not a private law contract. The scope of the utility or licence holder’s right to dispute the economic settlement is normally established in statute or in the licence itself. In respect of disputes regarding a regulatory price control determination, this usually involves an appeal to the Competition and Markets Authority (CMA).

However, the nature of the rights to review and powers of the CMA vary according to the sector. These may be specific rights of appeal on relatively narrow grounds (such as an error of fact or failure to give the appropriate weight to a particular matter) as seen in the energy sector. By contrast, in the water sector relevant appointees have a right to a redetermination by the CMA. In some circumstances judicial review may be available, but the bar for bringing an action is high. As a result, RAB models rely heavily upon the trust and confidence in the relevant regulator in achieving a reasonable settlement.

Whilst challenges relating to price controls and monopoly market oversight are usually distinct causes of action from environmental claims, in some circumstances this distinction can be blurred. A recent example from the UK water sector is claims brought under the collective proceedings regime for alleged breaches of the Competition Act 1998 before the Competition Appeal Tribunal. The proposed class representative alleged that six water and sewerage companies had under-reported pollution incidents on their networks, which led to them charging customers higher prices than otherwise would have been permitted. It was alleged that this constituted an abuse of a dominant position under UK competition law. Following a certification hearing, the Tribunal refused to certify the claims on the basis that they were excluded. The case illustrates, however, a growing trend towards non-traditional environmental claims in the energy and infrastructure sectors (for details, see our briefing here).

Who pays and why does it matter?

The mechanism for recovery of the allowed revenue is fundamental to the investability of the relevant regime. Whilst an applicable licence allows the holder an allowed revenue, how this is recovered and from whom depends on the individual RAB model. Under RAB models for core utilities such as natural gas, power and water, the allowed revenue is ultimately recovered from customers via their utility bills. In other sectors the group that charges may be recovered from may be more limited. For example, in carbon dioxide transportation and storage networks charges will be recovered from network users and, as a result, for initial projects the government has developed a package of measures to minimise non- payment risk.

It is because these services are generally central to the economy that these utilities and core infrastructure networks are also subject to significant public scrutiny. When service levels drop or prices rise, the press and the public take note. This can increase regulatory and reputational risk for investors and asset owners, particularly where there is under- performance or over-recovery (real or perceived).

Conclusion

RAB models are increasingly being used across a range of infrastructure and energy assets. However, although RAB models share similar aims and characteristics, material differences can be observed in their design and regulatory approach, as well as in the levels of public interest they attract. This may result in a different balance of risk and reward for asset owners and investors across the relevant models. As a result, with existing schemes under review and new RAB models under development, asset owners and investors would be advised to undertake a detailed assessment of the relevant reforms proposed and/or new models developed to ensure the appropriate balance is achieved.

This material is provided for general information only. It does not constitute legal or other professional advice.