Navigating the new cartel enforcement landscape

Download PDFNAVIGATING THE NEW CARTEL LANDSCAPE

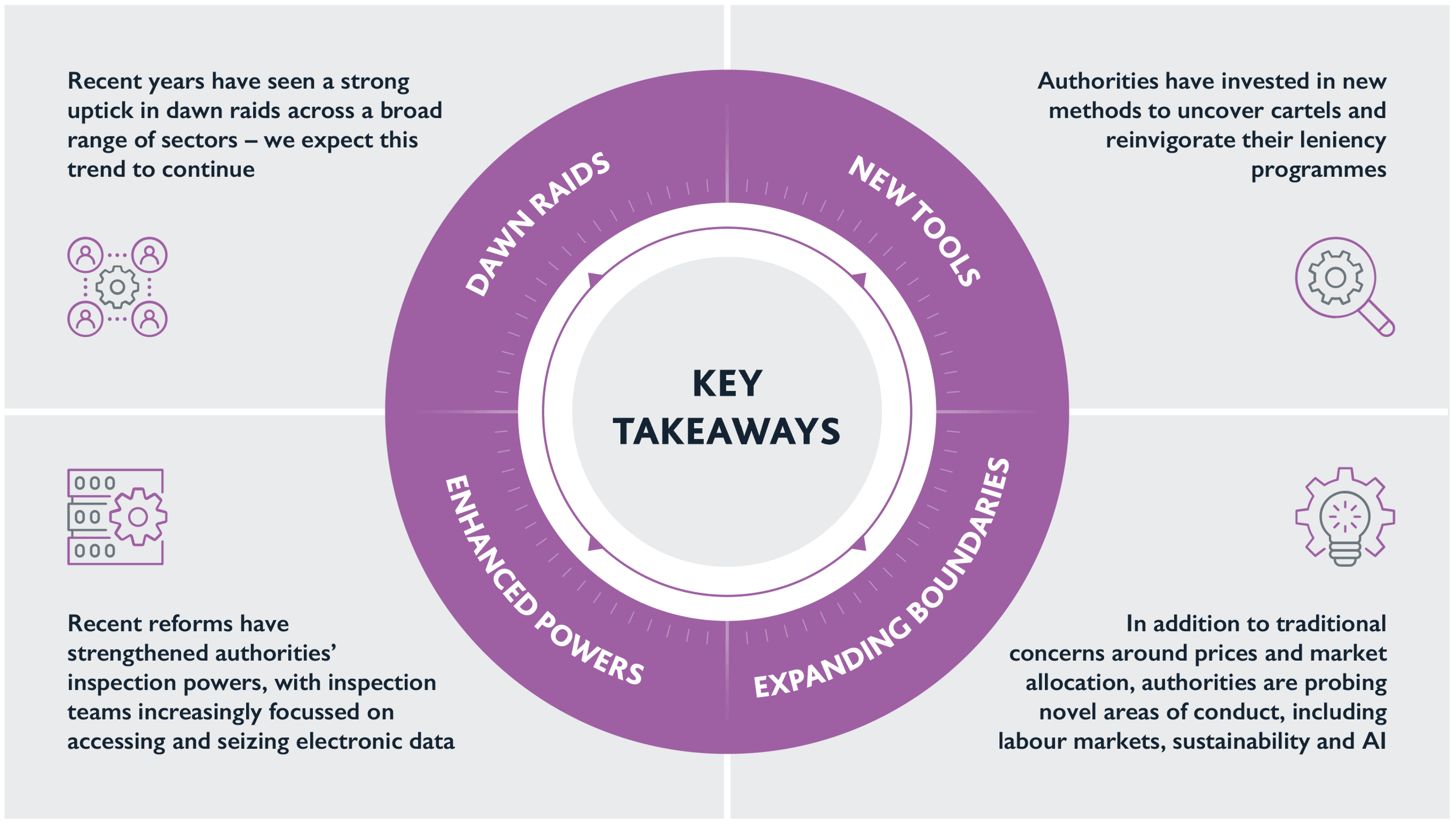

Recent trends and emerging risk

The European Commission (EC) is currently consulting on the future of Regulation 1/2003, setting the stage for a long-awaited overhaul of the EU’s procedural framework for antitrust enforcement.

This move comes amid a broader shift in cartel enforcement strategy, as authorities across the UK and Europe deploy new search powers and advanced tools to detect anti-competitive behaviour – including the use of AI and sophisticated market scanning. They are also probing novel areas of conduct, establishing new precedent for anti-competitive collusion.

RESTORING MOMENTUM IN CARTEL DETECTION

Dawn raids

Dawn raids are back and here to stay.

The UK Competition and Markets Authority (CMA) and the EC, as well as national competition authorities in the EU, all continue to be highly active in carrying out unannounced inspections (‘dawn raids’) in their respective jurisdictions.

The strong resurgence in dawn raids seen in the UK and in the EU since the end of the COVID-19 pandemic shows no sign of slowing. This surge in inspections has affected companies across a broad range of sectors, such as food and beverages, consumer goods, information and communication technology, financial services, pharmaceuticals, and construction, to name just a few.

This activity continues to come under challenge in the courts – with some recent successes for both defendants and the regulators.

Enhanced investigative powers

The uptick in dawn raids has been accompanied by recent reforms strengthening regulators’ powers in many jurisdictions, increasing the prospects of successful raids – particularly when authorities are conducting inspections at employees’ private homes, or when they are seizing devices and materials.

Investigatory trends

01 CROSS-BORDER COOPERATION

The surge in dawn raids has also seen regulators increasingly coordinating their enforcement action with authorities in other jurisdictions. Parallel inspections and information-sharing are increasingly becoming the norm. For example, in recent years, coordinated dawn raids in the fragrances sector and construction chemicals sector were conducted by the EC and CMA, alongside raiding authorities in other EU Member States and (in the case of the construction chemicals dawn raids) the Turkish Competition Authority.

In 2024, the EC and the US Department of Justice jointly stated that they are intensifying their efforts to exchange investigative leads, as well as information obtained from cartel whistleblowers on both sides of the Atlantic. The UK and EU Competition Cooperation Agreement is also expected to be signed later this year. The agreement will enhance cooperation between the EC and the EU authorities on the one hand, and the CMA on the other, with a view to facilitating information-sharing and the coordination of enforcement activities.

02 EX OFFICIO INVESTIGATIONS

To address a sustained drop in leniency applications and whistleblowers over the years, authorities have explored other enforcement routes and invested in new methods and technologies to uncover anti-competitive behaviour.

The CMA, the EC and many EU national competition authorities have publicly commented on their use of public data screening tools and databases to identify suspicious patterns of conduct and other market anomalies. In its recent Michelin judgment, the General Court shed new light on the scale and sophistication of the EC’s market surveillance function. The case (discussed in more detail below) illustrates the EC’s appetite to pursue innovative approaches to detecting cartel conduct. In addition, an increasing number of regulators have signalled that they are intensifying investments in algorithmic and AIdriven detection capabilities.

03 LENIENCY APPLICATIONS

Authorities have also sought to reinvigorate leniency programmes. In April 2025, the CMA launched a public consultation on proposed updates to its guidance on leniency and no-action in cartel cases, marking the first comprehensive review of the CMA’s leniency guidance in over ten years. The CMA considered how changes to its leniency policy could “best ensure that the incentives offered by the CMA’s leniency regime are in the right place to support the CMA’s enforcement objectives”. The CMA’s updates send a clear signal of its intention to reinforce incentives for self-reporting while complementing its evolving investigative capabilities.

The EC has undertaken similar efforts to replenish its pipeline of leniency applications. This has included, for example, modernising the EC’s e-Leniency platform in 2022, introducing Leniency Officers, and publishing new leniency FAQ documents to improve the transparency and accessibility of the programme for applicants and their advisers. These efforts appear to have been successful, as leniency applications are understood to be on the rise for the fourth consecutive year in the EU.

SECTORS IN THE SPOTLIGHT

Areas of focus

Competition authorities are casting a wide net across industries, with no sector being ‘off limits’.

Traditional targets such as pharmaceuticals, construction, and financial services remain firmly in regulators’ sights.

Moving beyond the usual suspects, however, we expect the UK and EU authorities to pay close attention to conduct that, in addition to its impact on competition, negatively impacts other policy goals.

This includes, in particular, cost-of-living constraints and areas of essential spending for consumers, sustainability and the green transition, public finances, and the renewed ‘pro-growth’ agenda in the UK and Europe.

PUBLIC PROCUREMENT

The CMA's Annual Plan for 2025 to 2026 identified key sectors and areas of focus for its enforcement efforts. The CMA intends to apply a particular focus on public procurement as part of its drive to increase value for taxpayers.

The CMA draws attention to the new regime under the Procurement Act 2023, under which suppliers found to have infringed competition law may be added to a new central debarment register and excluded from all public procurement for up to five years – unless they are a cartel immunity applicant or can show they have ‘selfcleaned’.

The CMA has also highlighted the increasing use of it ‘deep bid-rigging identification expertise’ to assist public sector organisations to identify anomalies in bidding data and indicators of potential illegal conduct.

SUSTAINABILITY

In April this year, the EC fined multiple car manufacturers and a trade association around €458 million for participating in a 15-year long cartel concerning end-of-life vehicle recycling and related advertising claims.

On the same day, the CMA concluded its own parallel investigation into similar conduct affecting the UK market, issuing fines totalling over £77 million. The CMA commented that such collusion can limit consumers’ ability to make informed choices and lower the incentive for companies to invest in new, greener initiatives and products.

The decisions highlight the growing focus of competition authorities on cartel enforcement in the age of the green transition.

DEFENCE

2023 saw the EC’s first ever cartel decision in the defence sector, in relation to a market-sharing cartel for the sale of military hand grenades.

In June 2025, the EC adopted the Defence Readiness Omnibus, a package of measures aimed at establishing a defence-readiness mindset across the EU. The Omnibus includes a communication setting out the EC’s proposed approach to competition rules as they relate to the defence sector. The EC notes it is ready to provide guidance on how companies in the defence sector may collaborate without falling foul of antitrust rules, acknowledging that collaboration may be necessary to scale up production, develop products or procure raw materials.

OUR CARTELS EXPERIENCE

Many of the world’s largest companies turn to us to advise them on business-critical competition matters

We have considerable expertise on all stages of UK and European cartel investigations, including dawn raids, leniency applications, settlements, appeals against infringement decisions and follow-on litigation.

In an area where both the law and practice are rapidly evolving, we have extensive recent experience of acting on cartel investigations and are therefore well-placed to advise on current best practice.

Clients in previous cases have particularly appreciated our willingness to offer a firm view to senior management on key decisions around potential cooperation, contesting proceedings and exposure to follow-on damages.

We are also regularly asked to provide compliance advice and training to our clients, including in relation to dawn raid preparedness. We have developed training materials, policy documents and inspection protocols for these purposes.

Our experience includes advising:

- A company active in the fragrance industry in relation to a CMA investigation

- A car manufacturer on the EC’s investigation into end-of-life vehicle recycling

- A luxury fashion retailer in relation to the EC investigation into the fashion industry

- A manufacturing company in relation to an EC investigation into basic industries

- British Airways in connection with the EC investigation into an alleged air cargo cartel in respect of fuel surcharges

- Deutsche Bank in the context of the multiple investigations relating to interbank offered rates

- Fuji Electric in the GIS and power transformer cartel cases

- ITV on the CMA’s investigation into the purchase of freelance services in the production and broadcasting of sports content

- JPMorgan Chase in relation to the EC’s investigation into trading on the foreign exchange market

- Platts in the EC’s investigation into oil and biofuels benchmarks

- Unilever on the EC’s investigation into the consumer detergents market

- Various housebuilders in relation to a CMA investigation

This material is provided for general information only. It does not constitute legal or other professional advice.